capital gains tax proposal effective date

Treasury Green Book Bloomberg Tax Accounting Bidens Capital Gains Proposal. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a.

5 2 Impairment Of Long Lived Assets To Be Held And Used

President Bidens American Families Plan proposes increasing the tax rate on long-term.

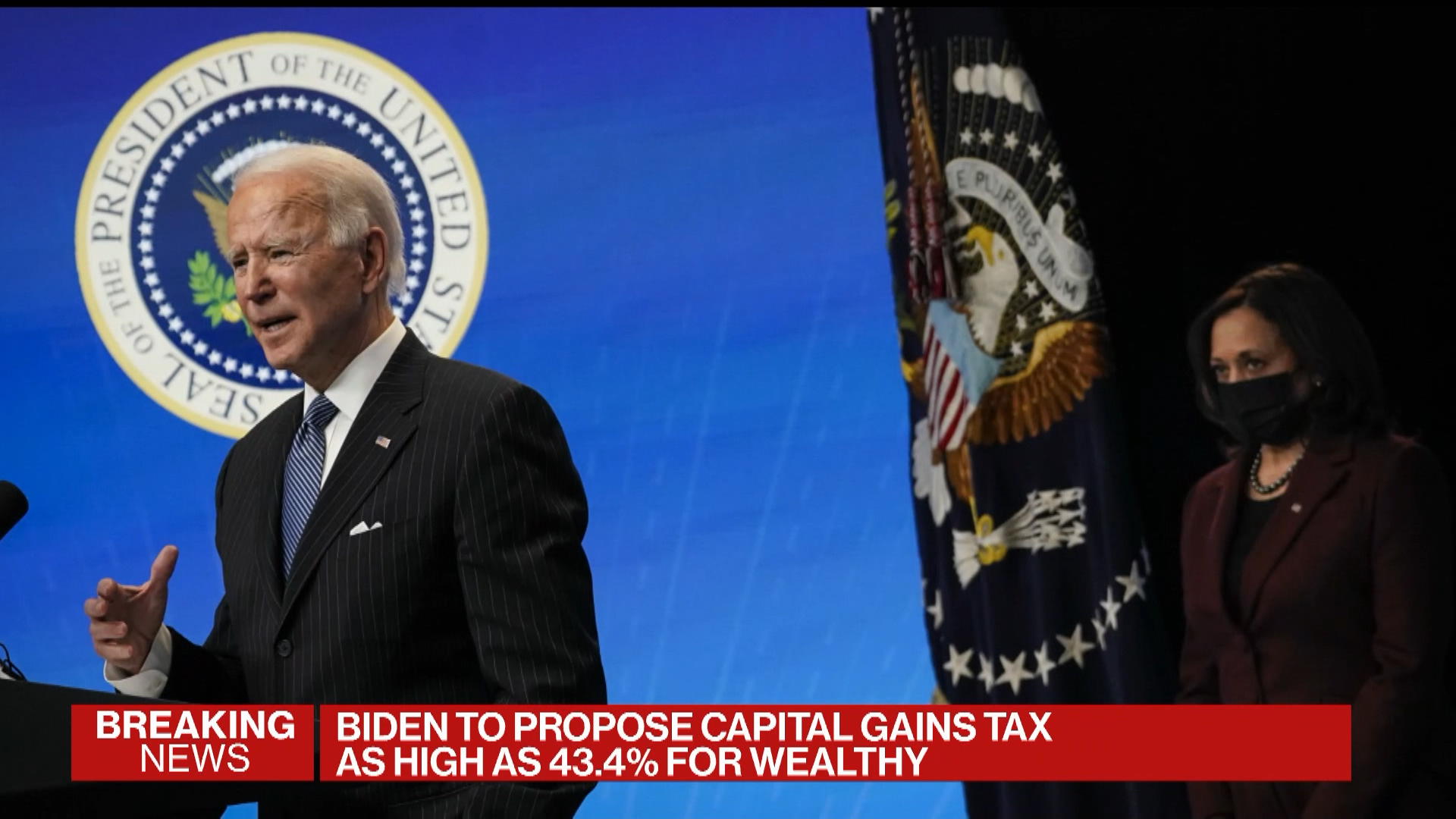

. Get Access to the Largest Online Library of Legal Forms for Any State. If this were to happen it may not only seem unfair but it is also bad tax policy. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. Which leads to the oft-asked question of when. In general the Biden Administration would make its tax proposals effective January 1 2022 which is how budget recommendations are ordinarily submitted.

The announcement of the plan formally kicked off the legislative discussions and prompted taxpayers to consider. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021. The Green Book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement Secretary Yellen intimated that date would be April 28.

JD CPA PFS. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of. 13 2021 unless pursuant to a written binding contract effective on or before Sept.

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of. A taxpayer with 900000 in labor income and 200000 in capital gains would have 100000 of capital gains taxed at the current preferential tax rate and 100000 taxed at ordinary income tax rates. Therefore the capital gains earned by the assessee on the sale of the flat have to be treated as long term capital gains.

As you review this alert it is critical to keep in. Ad The Leading Online Publisher of National and State-specific Legal Documents. The American Families Plan Fact Sheet Biden Administration General Explanation of the Administrations Fiscal Year 2022 Revenue Proposals US Dept of the Treasury BTAX OnPoint.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals. Effective Date Considerations KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when.

Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial increase in the capital gains rate. The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept. Effective Date Considerations KPMG Catching Up on Capitol Hill Podcast Episode 13-2021.

Dems eye pre-emptive capital gains effective date April 27 2021 Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. The effective date for most of the proposals is Jan. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains tax rate for households with income exceeding 1 million to 396 from the current 20 tax rate.

In the instant case the date of allotment is 11-4-2003 FY 2003-2004 and the date of sale of the property is 14-10-2007 therefore the holding period is more than 36 months. Bidens Capital Gains Proposal. The effective date for most of the proposals is Jan.

13 2021 unless pursuant to a written binding contract effective on. Top earners may pay up to 434 on long-term. Bidens Capital Gains Proposal.

Effective Date Considerations May 14 2021. There are exceptions however and some are notable. The top rate would be 288 when.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of it. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. In short we dont yet know the answer to this important question.

The proposal to tax long-term capital gains and qualified dividends for high-income taxpayers at ordinary rates would be effective.

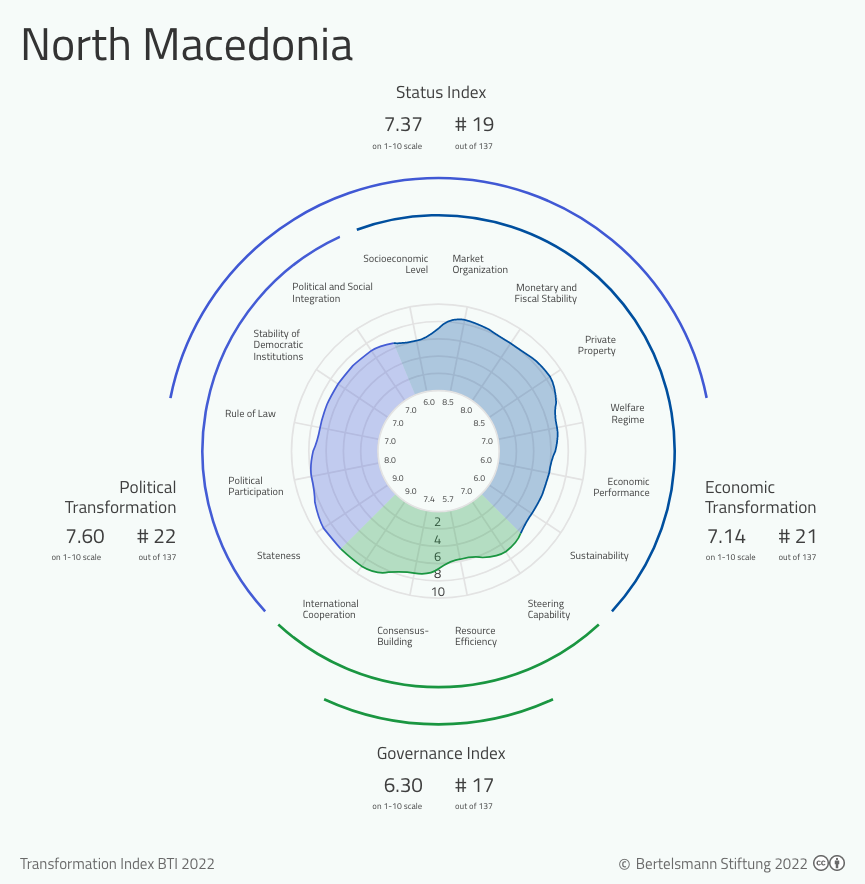

Bti 2022 North Macedonia Country Report Bti 2022

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

President Biden S Stepped Up Basis Tax Proposal Forbes Advisor

Follow Oasis Management S Oasis Capital Latest Tweets Twitter

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

Reimagining Our Futures Together A New Social Contract For Education

Like Kind Exchanges To Be Limited Under Biden S Tax Proposals

Changes In The Polish Deal Affecting The Real Estate Kpmg Poland

President Biden S Tax Plan Impacts Estate Planning Capital Gains

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

State Corporate Income Tax Rates And Brackets Tax Foundation